The ‘life after the mortgage’ plan.

We thought clearing the

mortgage would take a lifetime.

Thanks to bonuses we had

the money in no time.

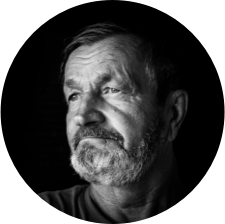

Mark, 45

Company Director, Pharmaceutical Industry

For Denise and I, the big house was the big dream.

I remember sitting in the sitting room and saying to

her, ‘All this is now ours.’ She said – ‘not bad for a

couple in their forties. What’s the plan now?’ No idea.

I replied.

The ‘life after the mortgage’ plan.

We thought clearing the

mortgage would take a lifetime.

Thanks to bonuses we had

the money in no time.

Mark, 45

Company Director, Pharmaceutical Industry

For Denise and I, the big house was the big dream.

I remember sitting in the sitting room and saying to

her, ‘All this is now ours.’ She said – ‘not bad for a

couple in their forties. What’s the plan now?’ No idea.

I replied.

I’m no financial adviser

but with interest rates

sitting at historic lows,

I knew sitting on a pile of

cash wasn’t a smart move.

A Nice Problem to Have

I was earning well, I had stock options in the business

and I was receiving regular bonuses, so with the mortgage

cleared, cash just started piling up.

My sons are keen surfers, so we discussed investing

in a holiday home by the sea. And I also knew that one

day I’d inherit my parent’s business.

But I wondered if buying more property would impact

my financial flexibility.

I’m no financial adviser

but with interest rates

sitting at historic lows,

I knew sitting on a pile of

cash wasn’t a smart move.

A Nice Problem to Have

I was earning well, I had stock options in the business

and I was receiving regular bonuses, so with the mortgage

cleared, cash just started piling up.

My sons are keen surfers, so we discussed investing

in a holiday home by the sea. And I also knew that one

day I’d inherit my parent’s business.

But I wondered if buying more property would impact

my financial flexibility.

A Timely Webinar

Then I saw a post on LinkedIn promoting a webinar from Goodbody – aptly titled ‘Investing in your 40s.’ I signed up, and listened in.

Goodbody followed up the seminar with a call and asked if I’d like an initial meeting. It proved enlightening.

Their financial planning process forced us to confront what I call ‘The Golf questions’, these are big questions that are easy to hit into the long grass:

- Can we afford that holiday home?

- When was the right time to cash in my stock options?

- How much will I need in retirement?

- Was my pension on track?

- When could I afford to retire?

- What were the implications of inheriting my parent’s business?

- How could we invest our cash?

The Goodbody Advice

There’s more to wealth than property.

Mark and Denise wanted to know how best to invest their capital,

at what age Mark could retire and if they could afford to purchase further property.

The first step was to help them understand their current net worth.

So, we drew their attention to three big numbers:

Current Net Worth

€2,242,229

This is the value of Mark and Denise’s assets today less their debt.

Current Net Worth

€2,242,229

This is the value of Mark and Denise’s assets today less their debt.

Projected Net Worth

€6,183,342

This is Mark and Denise’s

future net worth based on

their financial plans.

Projected Net Worth

€6,183,342

This is Mark and Denise’s

future net worth based on

their financial plans.

Legacy Net Worth

€4,252,229

This is the value of Mark and

Denise’s estate following their

deaths, which after exemptions

of €335K per child would leave

a taxable estate in the region of:

€3,582,229

Legacy Net Worth

€4,252,229

This is the value of Mark and

Denise’s estate following their

deaths, which after exemptions

of €335K per child would leave

a taxable estate in the region of:

€3,582,229

The Goodbody Advice

There’s more to wealth than property.

Mark and Denise wanted to know how best to invest their capital,

at what age Mark could retire and if they could afford to purchase further property.

The first step was to help them understand their current net worth.

So, we drew their attention to three big numbers:

Current Net Worth

€2,242,229

This is the value of Mark and Denise’s assets today less their debt.

Current Net Worth

€2,242,229

This is the value of Mark and Denise’s assets today less their debt.

Projected Net Worth

€6,183,342

This is Mark and Denise’s

future net worth based on

their financial plans.

Projected Net Worth

€6,183,342

This is Mark and Denise’s

future net worth based on

their financial plans.

Legacy Net Worth

€4,252,229

This is the value of Mark and

Denise’s estate following their

deaths, which after exemptions

of €335K per child would leave

a taxable estate in the region of:

€3,582,229

Legacy Net Worth

€4,252,229

This is the value of Mark and

Denise’s estate following their

deaths, which after exemptions

of €335K per child would leave

a taxable estate in the region of:

€3,582,229

Our projected net worth

was a welcome surprise.

The inheritance

tax liability facing the boys,

certainly wasn’t.

Our projected net worth

was a welcome surprise.

The inheritance

tax liability facing the boys,

certainly wasn’t.

A glimpse of the whole plan.

Through a combination of strategic recommendations

and lifetime cashflow modelling, we were able to

build Mark and Denise a plan that would enable them

to realise all their ambitions.

The lifetime cashflow model helped us understand the

consequences of decisions before we made them.

Key Recommendations

A glimpse of the whole plan.

Through a combination of strategic recommendations

and lifetime cashflow modelling, we were able to

build Mark and Denise a plan that would enable them

to realise all their ambitions.

Key Recommendations

The lifetime cashflow model helped us understand the

consequences of decisions before we made them.

A Final Thought From Mark

Goodbody gave us the confidence

to buy a place by the sea, so the boys

finally got the opportunity to teach

me how to surf.

A Final Thought From Mark

Goodbody gave us the confidence

to buy a place by the sea, so the boys

finally got the opportunity to teach

me how to surf.

What’s your plan?

Please contact us if you think your life could be enriched by a financial plan.

READ ANOTHER STORY